- #90000 LUMP SUM 7 YEARS FROM NOW FULL#

- #90000 LUMP SUM 7 YEARS FROM NOW FREE#

The list goes on and the savings may shock you.

#90000 LUMP SUM 7 YEARS FROM NOW FREE#

The result is a home that is free and clear much faster, and tremendous savings that can rarely be beat. To be more precise, it’d shave nearly 12 and a half years off the loan term.

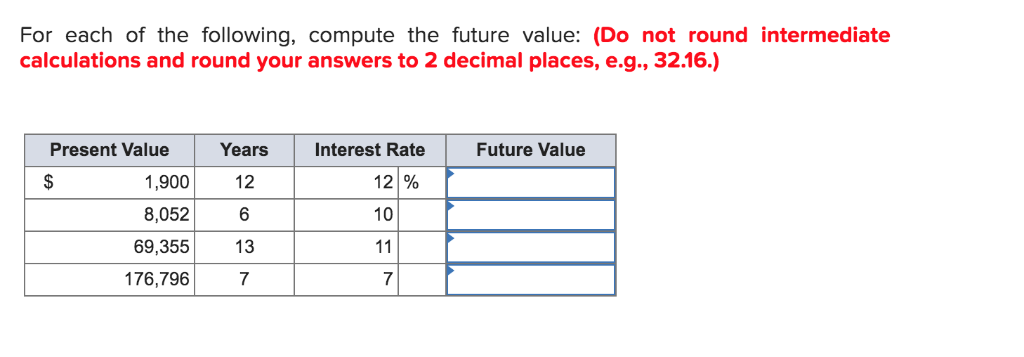

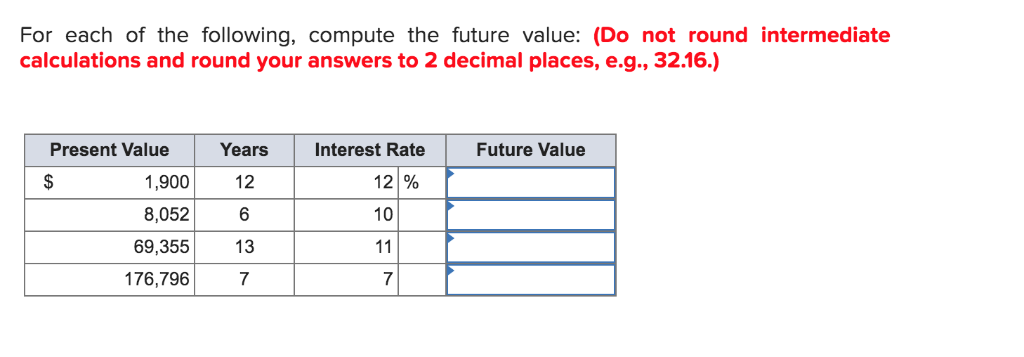

Paying an extra $1,000 per month would save a homeowner a staggering $320,000 in interest and nearly cut the mortgage term in half. Or consider a $600,000 loan amount set at 6% for 30 years. If you had a $300,000 loan amount set at 4.5% on a 30-year fixed, paying an extra $250 per month would save you almost $70,000 and you’d pay off your loan seven years and six months ahead of schedule. If you had a $400,000 loan amount set at 4% on a 30-year fixed, paying an extra $100 per month would save you nearly $30,000 and you’d pay off your loan two years and eight months early.

#90000 LUMP SUM 7 YEARS FROM NOW FULL#

If you paid an extra $500 per month, you’d save around $153,000 over the full loan term and it would result in a full payoff after about 21 years and three months. Imagine a $500,000 mortgage with a 30-year fixed interest rate of 5%. Once you click compute, you’ll see how much the extra mortgage payments will save in the way of interest over the life of the loan, and also how much faster you’ll pay off your mortgage. If you want to make a lump sum extra payment of $1,000, enter it and change the “Monthly” to “One Time” for an accurate calculation.

Then input the additional payment amount and whether it’ll be a monthly, annual, or one-time extra payment.įor example, if you plan to pay an extra $100 per month, you shouldn’t have to change anything with the default settings. Next, enter the mortgage rate and the date you plan to make the extra (or larger) payment. It will depend on the mortgage rate and the loan balance. Of course, that’s just a ballpark estimate. So if you’re currently paying $1,000 per month in principal and interest payments, you’d have to pay roughly $1,500 per month to cut your loan term in half.

To make extra payments based on your financial goalsįor example, if you’re interested in paying off your mortgage off in 15 years as opposed to 30, you generally need a monthly payment that is 1.5X your typical mortgage payment. Knowing the actual numbers can help you determine if it makes sense. Of paying off your home loan ahead of schedule. This calculator will illustrate the potential savings. Use the Early Mortgage Payoff Calculator to Determine the Actual Savings You input your original mortgage amount and can quickly see what paying extra will do in terms of both interest savings and shaving years off your mortgage. Put simply, it’s a standard mortgage calculator with extra payments built-in, so it’s really easy to use. Note: Most closed mortgage products allow a once-per-year lump sum payment of up to 20% of the remaining principal amount or balance.Įxample: if your balance at the end of the year is $100,000, the maximum lump sum payment for that year would be $20,000.If you own real estate and are considering making extra mortgage payments, the “early mortgage payoff calculator” below could be helpful in determining how much you’ll need to pay and when to meet a certain financial goal. If you would like to make a lump sum payment, please select the amount next to the respective year. The following is a yearly summary of your mortgage payments. Monthly Payments Compared To Other Payment Schedules Schedule To try experimenting with lump sum payments, select an amount in the yearly payment summary (above, under Yearly Mortgage Breakdown & Lump Sum Payments). Lump sum payments can have a dramatic effect on the amount of interest you pay and on the length of your amortization. To try it, select Biweekly accelerated as your payment schedule (above). If you opt for biweekly accelerated payments, you could save thousands of dollars over the course of your mortgage. You would make approximately 300 payments averaging about $2,178.11 over the course of 25 years.

0 kommentar(er)

0 kommentar(er)